Unlike most other online brokerages in Canada, TD Direct Investing doesn’t offer commission-free ETFs. Stock and ETF trading is free, but you’ll incur an in-built spread of up to 2% on crypto trades and a $10 monthly fee if you sign up for Wealthsimple Trade Plus. There’s also QuestWealth, which allows conservative investors to invest with pre-build, expertly managed portfolios at a fee of 0.20%-0.25%. Users can choose from investment account types, including TFSA, RRSP, margin cash accounts, and more, to invest and save for their long-term or short-term goals. That left many Canadian investors scrambling to find other trading apps like eToro.

These two platforms are also offered in their mobile versions that are available both in Android and iOS. In mobile trading, traders can trade whenever and wherever. The platform allows users to invest in a wide selection of market securities, including stocks, ETFs, options, futures/FOPs, cryptocurrencies, spot currencies, bonds, mutual funds, and hedge funds.

Service client

In addition, cryptocurrencies should be reserved for only the most speculative parts of your portfolio. For more than a decade, eToro has been a leader in the global Fintech revolution and social trading. It is the world’s leading social trading network, with over 10 million of registered users and an array of innovative trading and investment tools. With eToro, investors can easily create a portfolio with cryptocurrencies, stocks, commodities, ETFs and more, or simply copy the trading positions of more experienced traders. It offers a powerful web-based interface with advanced trading features and charting tools to help self-directed investors invest and manage their portfolios.

This fee comes with each withdrawal request of the client. Furthermore, eToro permits its clients to utilize the leverage multiplier, which basically maximizes the allowed amount to trade for each investor. For major currencies, it permits x30; for commodities, x10; for cryptocurrencies, x2, and for CFD stocks, x5. Use Tether for deposits and withdrawals to your trading account with one of the following Forex brokers. Trade Forex as well as CFDs on cryptocurrencies, stocks, indices and commodities with an STP/ECN broker.

Dont trust them with your money

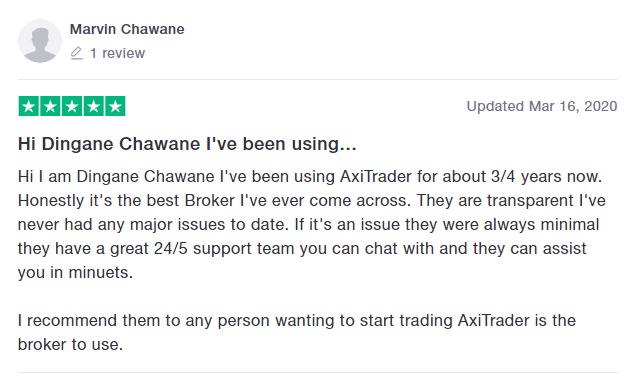

EToro’s customer service is extremely easy to reach via email, telephone and live chat. The staff are friendly and answer queries quickly and properly. The big advantage of eToro is that beginners particularly have the chance to get answers to questions there via the community. Under certain circumstances, this may even be more useful, so the trader doesn’t necessarily have to contact customer service with every problem and question. Nevertheless, this is not a problem for the staff, especially since they can be reached very easily in various ways. Minimum deposit – Opening a trading account with eToro is fast and can be done online, taking around 10 to 15 minutes to complete the required forms and verification process.

- Check out the table below to compare some of Canada’s most popular robo-advisors and read our reviews of each to decide which one is right for you.

- You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

- Not only is eToro one amongst the brokers who also enable trading in crypto currencies such as Bitcoin or Ethereum via the corresponding crypto CFDs.

- Especially with the live chat we had very good experiences and always received help within a few minutes.

- Back to the spreads, with eToro, for the most traded pair, the EUR/USD spread on both Retail and Professional accounts starts at 1.0 pip, with an average of 1.1 pip.

- EToro has created a user-friendly platform with innovative ideas and has since become the largest and famous brokerage firm in the industry of trading.

The OSC claimed it had warned eToro about these problems multiple times between 2010 and 2015. However, eToro reportedly made no efforts to block Canadians from trading on its platform. EToro won’t let you open an account if you live in Canada – but there are other investment services that will.

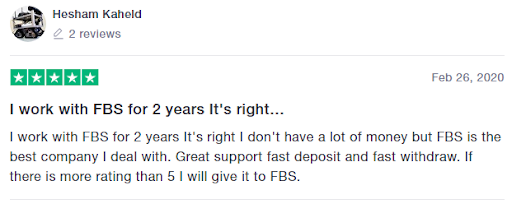

A lot of options to invest money, possibility to copy successful players. Only issue I’ve had with the service is the occasional delayed opening of volatile trades, but not enough to reduce from 5 stars. Just as when you trade on any other platform, it is worthwhile to read up on charges and structure your approach accordingly. Customer support is brilliant and quick to respond in the forums.

Accounts, Instruments and Platforms

With more than 25 million users from over 140 countries and more than 3000 financial instruments including stocks, commodities, crypto, indices, and ETFs, eToro continues to revolutionize online investing. In conclusion, eToro is a secure brokerage company, providing excellent services to traders and, in turn, deserves to be in its spot as one of the biggest and most favored brokers out there. Besides, eToro’s Standard Accounts feature a rewards system that encourages and rewards account holders for bringing other traders to its partner programs or social trading community. Finding a good brokerage firm is a key factor in your success as a trader. Many traders are uncertain in this phase of trading as there are many brokerage firms in the market today, but only a few of them prove to work in the best interest of their clients.

The best time to buy stocks could be right after an IPO, during expansion periods or when other investors are buying or selling. The best stock trading app for beginners is easy to use and offers free trades. An investment platform that enables users to buy and sell stocks in fine art securities.

These https://forex-reviews.org/ include accessing the financial market with ease and directly interacting with various traders globally without any form of monetary fee. EToro is a financial service provider founded in 2007 and headquartered in Cyprus. It is a brokerage firm that aims to introduce a new approach to the industry of trading and has launched a trading platform that caters to all types of traders. Compare Forex brokers that accept Paypal for deposits and withdrawals.

eToro Review 2023: Pros & Cons – Forbes Advisor UK – Forbes

eToro Review 2023: Pros & Cons – Forbes Advisor UK.

Posted: Tue, 07 Mar 2023 08:00:00 GMT [source]

Definitely worth considering if you are looking for an online investment platform, stable, secure and mobile app is very good as well. In eToro’s mobile trading app, a research button is made available for the clients. However, this research button, along with market analysis, is only available for clients who have funded accounts. They have an internal blog where various topics on forex and other financial subjects are discussed. The blog provides a lot of information about cryptocurrencies in comparison with topics about forex or market analysis. The articles on cryptocurrencies mostly tackle about its beginnings and how it boosted in 2017.

Forex Brokers that Accept Credit Cards

Buy and sell CFDs on Tesla shares in Canada without commission when you open an account with one of these brokers. Buy and sell CFDs on Apple shares in Canada without commission when you open an account with one of the following brokers. Find a Forex trading account that meets your trading preferences whether that’s on MT4, cAlgo or JForex. Compare Forex demo accounts up to $100,000 with no time limit. Compare Forex brokers in Canada with micro accounts, well suited for smaller trade sizes. A PAMM account could be right for you, if you lack the time or experience to trade Forex.

- After that it may take some more time until the transaction is visible in the eToro Wallet, because the transaction still has to be processed in the Bitcoin blockchain.

- This is when I discovered eToro OpenBook, a massive and friendly trading community.

- You get snap quotes in real-time on both the web-based platform and IQ Edge.

- Another of the platforms they offer is WebTrader, which is a notable platform generally considered to be reliable.

This apparently is in their T&Cs but is not made clear anywhere when you sign up, and you are only told about it after you have withdrawn and been charged it. I would encourage you to visit our own platform and speak to customers who use our service daily and have done so for years to get a more accurate idea of what eToro is like. Could you please provide more info as to why your experience has been negative?

For accounts opened via any entity of the eToro Group, there is a default Negative Balance Protection mechanism in place, for the sake of no negative balance. With NBP, eToro customers are protected from any losses bigger than their original investments, in cases of extreme market volatility. The eToro Ltd entity is a member of the Investor Compensation Fund , an investor compensation fund for CIF clients and its functions are regulated by the directive DI87-07 of the CySEC. During this processing, the transaction appears as a “pending transfer” in the portfolio.

And finally, in terms of the “tools”, they don’t even have volume in the price charts. In the beginning I was a little skeptical to try eToro, or any Forex trading platform for that matter. I was new to the world of currency exchange and I could not find any trading communities. This is when I discovered eToro OpenBook, a massive and friendly trading community. I decided to give it a try and I cannot say that I’ve ever had any problems.

Pros & Cons of CIBC Investor’s Edge

OpenBook is a platform that focuses on social trading and permits clients to communicate and access various trading communities and investors. Most platforms charge a fee every time you buy and sell stocks. If you’re investing in mutual funds or other professionally-managed investment pools, you’ll be charged a fee that encompasses both trading costs and management expenses. Since its launch, eToro’s trading platform has kept its word and stayed true to its vision, making it grow in popularity through its innovative prowess and near-unlimited features. Its reach has spread as far as over 150 countries worldwide.

etoro forex broker review is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Etoro is not without reason one of the largest and most popular brokers in Europe. Although the platform only offers 15 different cryptocurrencies, which can be purchased either as “real” assets or as CFDs, the platform does not offer a full range of cryptocurrencies. Here you set the amount of money you want to invest in this trade as usual. For cryptocurrencies, eToro does not currently offer any higher leverage. You should then check your Stop Loss and Take Profit settings.

EToro’s best materials, according to most of its clients and users, are the website’s daily and weekly blog-posts that delve in crypto-currency. However, eToro’s website also features adequate research and educational materials and topics for Forex and other financial markets. These can also be there a vast library of links to YouTube videos that delve deeper into their respective subjects. Being the largest crypto exchange in the world, Binance works well for crypto enthusiasts looking for a one-stop crypto hub to trade cryptocurrencies and access all manner of crypto services.

eToro Review – Is eToro the Best Broker in April 2023? – Business 2 Community TR

eToro Review – Is eToro the Best Broker in April 2023?.

Posted: Thu, 30 Mar 2023 11:45:53 GMT [source]

A stop-loss limit is very important to limit the possible risk. Be careful when considering high-risk investments like cryptoassets & cryptocurrencies (e.g. bitcoin). Their value can go up and down significantly, without any warning. This trading course offers an introduction to understanding how the financial markets work and how to trade successfully. In other aspects, eToro’s mobile trading platform applications have research options that send messages to premium account users regarding the fundamental and technical analysis. EToro takes pride in the fact that they do not charge any commissions for any trades conducted and that all their fees are established from a fixed spread.